Difference between revisions of "EIA’s projections for individual tight oil plays"

Masoninman (talk | contribs) (tweaked image; added heading formatting; added links) |

Masoninman (talk | contribs) m (added image) |

||

| Line 19: | Line 19: | ||

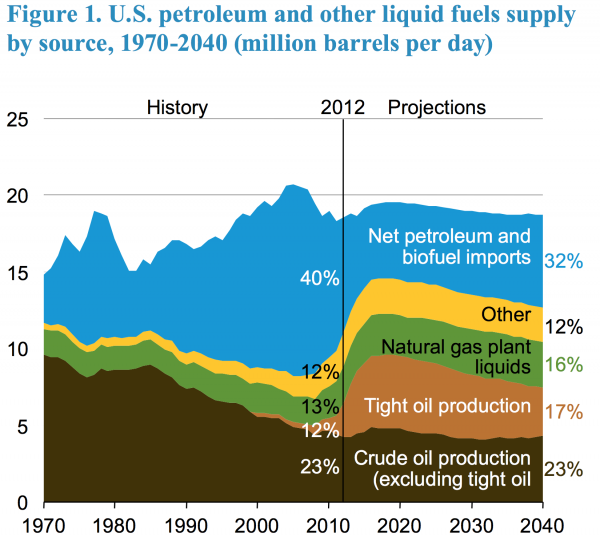

In their 2014 Annual Energy Outlook (AEO), EIA forecast that tight oil production will continue rising for only a few more years, then stay on a plateau for a few years, and finally enter a slow decline. If correct, this would mean the U.S. oil boom would soon end—or, it would mean the transition of tight oil production, from a boom phase to a mature phase. | In their 2014 Annual Energy Outlook (AEO), EIA forecast that tight oil production will continue rising for only a few more years, then stay on a plateau for a few years, and finally enter a slow decline. If correct, this would mean the U.S. oil boom would soon end—or, it would mean the transition of tight oil production, from a boom phase to a mature phase. | ||

| − | [ | + | [[File:2014 EIA AEO (early) Fig 1 - US liquid fuels by source 1970-2040.png|600px]] |

| − | Figure 1 from EIA’s AEO 2014 (early release). | + | ''Figure 1 from EIA’s AEO 2014 (early release).'' |

That 2014 forecast for tight oil, and for total oil production, was considerably higher than the tight oil forecasts in their earlier AEOs. | That 2014 forecast for tight oil, and for total oil production, was considerably higher than the tight oil forecasts in their earlier AEOs. | ||

Revision as of 11:25, 2 January 2015

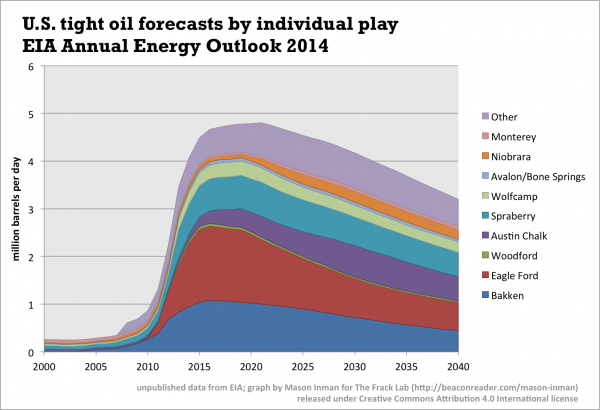

The EIA gave me their long-term projections—previously unpublished—for oil production from individual tight plays, including the Bakken, Eagle Ford, Wolfcamp, Bone Spring, Spraberry and more, out to 2040. These are the areas wholly responsible for the U.S. oil boom of the past several years, so I’d think there would be wide interest in EIA’s forecasts for particular plays. Yet the EIA has not released these forecasts themselves.

I’m posting the data here—freely available—for anyone who is interested. First I’ll show the data, then list links for downloading this data set and some other related data. Finally I’ll tell more about how I got the data, and put it in context.

Data set downloads

To download these data sets as xlsx files, follow the links below to the xlsx pages, then click the button “RAW.”

1. tight oil production forecasts from EIA’s Annual Energy Outlook 2014 [not previously published]: file and [1] file.

2. tight oil production forecasts from EIA’s Annual Energy Outlook 2013 (in that report): file and [2] file.

3. EIA’s historical tight oil production data, through May 2014 [not previously published]: file and file.

EIA’s tight oil forecasts

In their 2014 Annual Energy Outlook (AEO), EIA forecast that tight oil production will continue rising for only a few more years, then stay on a plateau for a few years, and finally enter a slow decline. If correct, this would mean the U.S. oil boom would soon end—or, it would mean the transition of tight oil production, from a boom phase to a mature phase.

Figure 1 from EIA’s AEO 2014 (early release).

That 2014 forecast for tight oil, and for total oil production, was considerably higher than the tight oil forecasts in their earlier AEOs.

[US tight oil 2012 vs 2013 vs 2014]

So naturally I was curious to find out what that higher forecast in 2014 was based on. Their 2013 annual report had shown a breakdown like this, with the Bakken, Eagle Ford, Permian (which is actually a collection of different plays), and an “other” category.

[FIG 97]

EIA Annual Energy Outlook 2013, Figure 97.

The 2014 annual report didn’t show any breakdown like this for all the individual plays. But it did show a forecast for Eagle Ford—so I figured they’d continued making forecasts for other plays. I got a hold of one of their analysts to ask—and it turned out they had made even more detailed forecasts than I expected, covering more than ten different plays. They sent me the year-by-year data points out to 2040—which also included historical data for each play back to 2000.

I think everyone should have easy access to this data—both historical and forecast—so I’ve posted them on Github (links above). A new report out today, “Drilling Down,” compares these same EIA forecasts against his own forecasts. (I’ll write more about Hughes’ report in later posts.) EIA’s historical tight oil data

It’s not easy to get a hold of good historical data on the individual plays—that is, without having a subscription to an expensive database like DrillingInfo. The EIA does show historical production by play for natural gas from shale plays (although as I pointed out in an earlier post, “The original shale gas field is tanking,” the recent months of data may be only estimates—and may get revised).

For whatever reason, they don’t provide data on tight oil by play. But in presentations and in posts in their “Today in Energy” series, they do sometimes show graphs of the production by play, like this:

[Sieminski presentation]

Historical data on tight oil production by play, from September 2014 presentation by EIA executive director Adam Sieminski. The slides noted: “Sources: EIA derived from state administrative data collected by DrillingInfo Inc. Data are through July 2014 and represent EIA’s official tight oil & shale gas estimates, but are not survey data. State abbreviations indicate primary state(s).”

Every month I gather the latest numbers of production of shale gas by play, from EIA’s Natural Gas Weekly Update. In June, when I downloaded the latest data set, I was initially confused. It was listing a different set of plays than usual. I realized it was actually the data for tight oil production by play. They’d accidentally posted the wrong data set, and soon after fixed that. But that gave me monthly production numbers from Jan 2000 to May 2014—a great collection of data to have. The link to that set is above as well.

For what it’s worth, this historical data for each play closely matches the historical portion of the AEO 2014 data I got from EIA.